MILAN – Nestlé shares soared this morning on the stock market following the publication of the company’s results for the first nine months and the announcement of a drastic reduction in its workforce. Coffee and confectionery were the main sales growth drivers. Nespresso had a solid performance. The Swiss multinational – the world’s largest food and coffee group – released better-than-expected financial results today, Thursday 16 October, while confirming its outlook for the full year. It also announced plans to raise its cost-saving targets from CHF2.5 to CHF3 billion francs by 2027 (CHF1 = US$1.25).

This measure will be accompanied by 16,000 redundancies over the next two years, representing almost 6% of Nestlé’s global workforce, including 12,000 white-collar workers and a further 4,000 headcount reduction, as part of ongoing initiatives to streamline and improve the efficiency of the supply chain.

The aim is to send a strong signal to regain market confidence and restore the value of the stock, which has lost 40% since 2022, causing discontent among the diverse shareholder base.

Nestle has endured an unprecedented period of managerial turmoil last Summer, with the dismissal of CEO Laurent Freixe, due to an undisclosed relationship with a direct report, and the subsequent resignation of Chairman Paul Bulcke, replaced respectively by Nespresso CEO Philipp Navratil and former Inditex chief Pablo Isla two weeks later.

“The world is changing, and Nestlé needs to change faster,” Mr Navratil said in a statement. “This will include making hard but necessary decisions to reduce headcount,” he added.

In terms of results, Nestlé reported a stronger-than-expected 4.3% rise in third-quarter sales, made possible by 1.5% growth in real internal growth (RIG) – a measure of sales volumes – well above the +0.3% forecast by analysts.

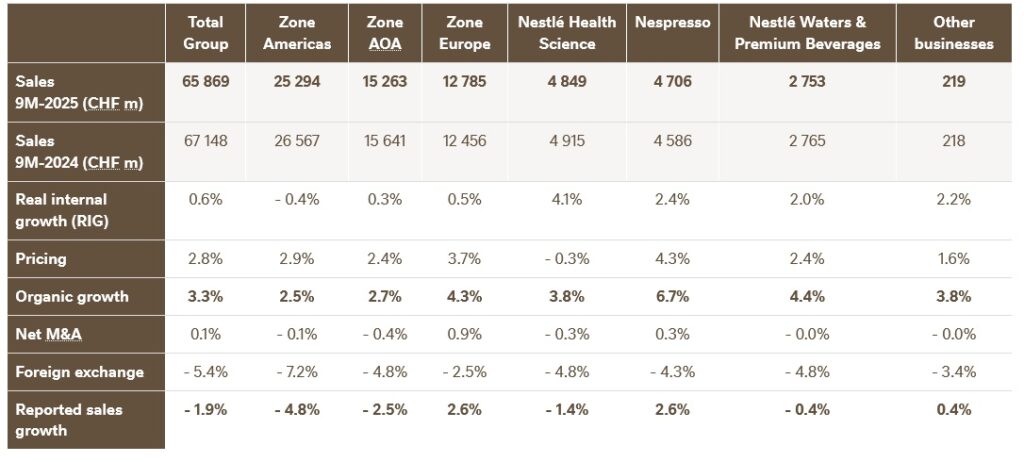

However, sales for the nine months amounted to CHF65.869 billion, down 1.9% from CHF 67,148 billion in the same period in 2024, affected by unfavourable exchange rates. In the first nine months, RIG grew by 0.6%.

“We are fostering a culture that embraces a performance mindset, that does not accept losing market share, and where winning is rewarded,” Navratil also said. “The world is changing, and Nestlé needs to change faster.”

source: Nestlé

source: Nestlé Financial and operational highlights

Broad-based topline improvement

- 9M organic sales growth (OG) of 3.3%, with 0.6% real internal growth (RIG) and 2.8% pricing.

- OG strengthened sequentially during the period across all Zones and major global businesses, led by improved RIG across all major categories.

- Q3 OG of 4.3%; RIG recovered strongly to 1.5%, driven by our growth investments and actions to manage price elasticity, helped by an easier comparison base.

- Greater China continues to be a drag, impacting Q3 Group OG by 80 bps and RIG by 40 bps; new management is now in place and executing our plan to transform this business.

Growth investments delivering results

- In 9M-25, OG increased to 3.3% from 2.0% in 9M-24. The vast majority of this 130 bps acceleration was driven by areas where we are focusing growth investments and execution improvement:

- – 60 bps from our priority growth opportunities (which accounted for 10% of total sales), where OG accelerated to 14% from 7%;

- – 40 bps from the 18 key underperforming business cells, where OG improved to flat from -2.5%.

By category, coffee and confectionery were the largest organic growth contributors. This growth was pricing-led, with double-digit increases in some markets. Elasticity was more pronounced in confectionery, consistent with historical trends, with coffee more resilient as RIG remains positive through the nine month period. Outside of coffee and confectionery, organic growth was positive across most categories.

Nestlé 2025 guidance

Organic sales growth is expected to improve compared to 2024. Sequentially, momentum remains positive, although the comparison base will be tougher in Q4.

UTOP margin is expected to be at or above 16.0%, as we invest for growth; this includes increased negative impact from tariffs currently in place and current foreign exchange rates.

Despite ongoing risks from macroeconomic and consumer uncertainties, the company remains committed to investing for the medium term.

Nespresso

Nespresso delivered robust OG of 6.7%, led by pricing and with solid RIG. In North America, it increased it growth investments and delivered double-digit growth with market share gains. Vertuo continued to deliver very solid performance with positive growth across all geographies. In Western Europe, the environment remains competitive.

In Q3, OG was 8.5%, with 3.3% RIG and 5.3% pricing. OG was driven by the US, supported by strong impact in the quarter from the timing of innovation launches and marketing campaigns, as well as some phasing effects. In Europe, RIG trends improved in key markets such as France, Switzerland and UK & Ireland, supported by growth in e-commerce and resilience in out-of-home.

Segment performance summary for 9M-25:

- Organic growth was 6.7%, with 2.4% RIG and 4.3% pricing.

- Reported sales growth was up versus the prior year at CHF 4.7 billion, including a negative foreign exchange impact of 4.3%.

- Market share gains in North America continue to increase while stabilizing in Europe.

Key organic sales growth drivers for 9M-25

- By geography, sales in North America grew at a double-digit rate, led by RIG. Growth was fueled by strong innovation (limited editions, functional coffees, double espresso formats, accessories) and effective brand campaigns and collaborations. Europe posted positive growth, with improving trends across key markets in Q3.

- By system, growth was driven by Vertuo. Sales for out-of-home channels grew mid single-digits, led by the hotels, restaurants and catering (horeca) sector and positive machine placements.

- Digital transformation continues to drive growth. The new mobile app is now live in 21 markets, we have successfully launched Starbucks direct-to-consumer in several markets, and we are expanding in e-retail and marketplaces.

The post Nestlé reports nine-month sales of CHF 65.869 billion (-1.9%), Nespresso sales at CHF 4.706 billion, company to cut 16,000 jobs worldwide appeared first on Comunicaffe International.